Creating the Test Submission

This process creates an XML file and populates the required fields for a test communication to the reporting body. Once the reporting body (for example, the IRS) informs you that your test submission was accepted, you do not need to use this procedure again.

The IRS provides various test scenarios, and each test requires the system to have invalid Social Security numbers embedded.

The system is configured to allow the SSN required for Tests 3-0 and 3-1. Please use Tests 3-0 and 3-1 for the approval process, as described here.

Note: For further details, please see the Test Package for Electronic Filers of Affordable Care Act (ACA) Information Returns (AIR) here.

Overview

To set up data for the one-time IRS test transmission:

| 1. | Set up your test client. |

| 2. | Set up your test employee. |

| 3. | Update the client Form 1094 record. |

| 4. | Update the employee Form 1095 record. |

These steps are reviewed in detail below.

Setting Up the Test Client

Ensure that your test client has the following setup. Create a new test client if one does not already exist. Otherwise, update the existing client.

|

Field |

Value |

|---|---|

|

Client Name (DBA) |

Selitestthree |

|

Legal Name |

Selitestthree |

|

Address |

6689 Willow Court |

|

ZIP Code |

90211 |

|

City |

Beverly Hills |

|

State |

CA |

|

Tax tab > Federal Employer ID Number |

000000301 |

Click Save when finished.

Setting Up the Test Employee

Ensure that your test employee has the following setup. Create a new test employee if one does not already exist. Otherwise, update the existing employee.

|

Field |

Value |

|---|---|

|

Last Name |

Southern |

|

First Name |

Theresa |

|

Employee SSN |

000000350 |

|

Resident Address Details |

|

|

Address |

342 Ash Ave |

|

ZIP Code |

98104 |

|

City |

Seattle |

|

State |

WA |

|

County |

King |

Click Save when finished.

Updating the Client Form 1094 Record

You must set up the information as described below, and only that information. If you submit information in any fields not included in these procedures, the IRS might reject your submission.

To set up the 1094 record for a one-time test transmission:

| 1. | Ensure that you have set up the test client and employee as described above. |

| 2. | Under Work Centers|Compliance, select ACA Processing. |

| 3. | Under ACA Processes, select Edit 1094 Form. |

| 4. | Select the appropriate year. |

| 5. | In the Part 1 panel, enter the following information: |

|

Field |

Value |

|---|---|

|

7. Contact Name |

Rose Lincoln |

|

8. Contact Phone |

555-987-6542 |

|

Designated Government Entity |

|

|

9. Name |

Selitestthree State Government |

|

10. Employer EIN |

000000302 |

|

11. Street Address |

1155 Alder Avenue |

|

12. City |

Sacramento |

|

13. State |

CA |

|

14. Country/Zip Code |

(leave Country blank) 94203 |

|

15. Contact Name |

Sam Castle |

|

16. Contact Phone |

555-111-5555 |

| 6. | In the Part 2 panel, enter the following information: |

|

Field |

Value |

|---|---|

|

20. Total Forms 1095-c File By And/or On Behalf Of Ale Member |

455 |

|

21. Is ALE Member a Member of an Aggregated ALE Group? |

Yes |

| 7. | In the Part 3 panel, enter the following information: |

|

Field |

Value |

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

23. All Twelve Months |

|||||||||||||||||||||||||||||||||||||

|

A. Minimum Essential Coverage Offer Indicator |

Yes |

||||||||||||||||||||||||||||||||||||

|

D. Aggregated Group Indicator |

Enabled |

||||||||||||||||||||||||||||||||||||

|

Individual months (lines 23-35) |

|||||||||||||||||||||||||||||||||||||

|

A. Minimum Essential Coverage Offer Indicator |

Set all to Yes |

||||||||||||||||||||||||||||||||||||

|

B. Section 4980H Full-Time Employee Count for ALE Member |

Set the following values for each month:

|

||||||||||||||||||||||||||||||||||||

|

C. Section 4980H Full-Time Employee Count for ALE Member |

Set the following values for each month:

|

||||||||||||||||||||||||||||||||||||

|

D. Aggregated Group Indicator |

Enable each box for all months |

||||||||||||||||||||||||||||||||||||

| 8. | In the Part 4 panel, add the following items to the grid of other Aggregated ALE Group Members: |

|

Name |

EIN |

|---|---|

|

Selitestthree Subsidiary One |

000000302 |

|

Selitestthree Subsidiary Two |

000000303 |

|

Selitestthree Subsidiary Three |

000000304 |

|

Selitestthree Subsidiary Four |

000000305 |

| 9. | Finally, in the Federal Transmittal Information panel: |

| • | Set Test Scenario to 3-0. |

| • | Set Test Month to 1. |

| 10. | Click Save. |

Updating the Employee Form 1095 Record

You must set up the information as described below, and only that information. If you submit information in any fields not included in these procedures, the IRS might reject your submission.

Note: No other 1095 records should exist for this test client and year.

To set up the 1095 record for a one-time test transmission:

| 1. | Ensure that you have completed the procedures above. |

| 2. | Under Work Centers|Compliance, select ACA Processing. |

| 3. | Under ACA Processes, select Edit Employee 1095 Form. |

| 4. | Select the appropriate Employee ID and Year. |

| 5. | Set up the Employee Offer of Coverage grid as follows: |

|

Month |

Offer Code |

Employee Contribution Amount |

Safe Harbor |

|---|---|---|---|

|

January |

1H |

|

|

|

February |

1H |

|

|

|

March |

1H |

|

|

|

April |

1H |

|

|

|

May |

1H |

|

|

|

June |

1E |

139.00 |

2C |

|

July |

1E |

139.00 |

2C |

|

August |

1E |

139.00 |

2C |

|

September |

1E |

139.00 |

2C |

|

October |

1E |

139.00 |

2C |

|

November |

1E |

139.00 |

2C |

|

December |

1E |

139.00 |

2C |

| 6. | In the Federal Transmittal Information panel, set Test Scenario to 3-1. |

| 7. | Click Save. |

Generating the Test Submission

Once you have set up the test client and test employee (and their 1094 and 1095 records), you are ready to create the test file.

Note About File Sizes

The transmission file must be smaller than 100 MB. However, there is no consistent rule about the number of records that will cause a file to exceed 100 MB. Internal testing shows that it involves many thousands of employees. Please check the size of the output file after you create it. If it exceeds the limit, use the From Employee and To Employee fields as described below to specify a range of employees instead.

Procedure

WARNING: Before running this process, ensure that there are no users accessing any 1094-C or 1095-C records in the system. If anyone is editing those records, the system will hang.

To send the test submission to the IRS:

| 1. | Select the Reports menu |

| 2. | Enter the appropriate Year. |

| 3. | Enable the Test Mode option. |

| 4. | If this is a large client and you need to create multiple smaller files, use the From Employee and To Employee fields. The IRS requires that the XML file be less than 100 MB in size. |

If the file size does not exceed 100 MB, continue.

| 5. | Set Submission Type to Original. |

| 6. | Click Create File. If there are many hundreds or thousands of records, this can take a few minutes; the system might time out without warning you. Please contact the PrismHR Customer Support Team if you experience an issue. |

Checking the Generated File

The system creates a ZIP archive containing two files: the form file and the manifest file. The manifest file includes the unique transmission ID for the client company, and the system populates that ID in the Par 1 panel of the Client 1094 record.

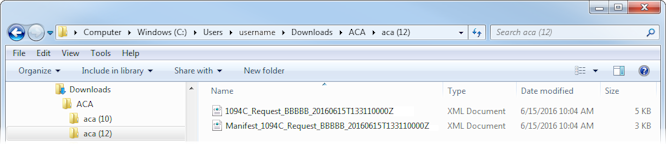

If you unzip the aca.zip file, you will see two XML files with similar names, as in the example below. The manifest file has the prefix Manifest_, and the other file contains the Form 1094-C and Form 1095-C information. Make sure that the files are smaller than 100 MB. If they are not, you must perform the procedure again and follow the instructions for . You can also for more information.

Note: The two files you ultimately submit must have the same time stamp (check the Date modified column in your file explorer, as shown below).

See Reviewing the ACA Transmission File XML Output for error checking suggestions. When you are satisfied with the contents of the files, you can submit them to the IRS (see AIR Transmission: Uploading the ACA Files or the appropriate state reporting entity. Remember: as soon as you receive your receipt ID from your reporting entity, enter it in the system: see Entering the IRS Receipt ID.