Using Billing Codes

Use the Billing Codes form to define billing entry and accounting information.

There are certain bill codes that PrismHR requires, and rules for others. Here is a list of codes used as system defaults and their usage:

| • | 000: Gross Wages |

| • | 001: FICA/OASDI |

| • | 002: FICA/Medicare |

| • | 003: FUTA |

| • | 004: SUTA |

| • | 004O: Other State Tax (when needed) |

| • | 005: Workers' Compensation |

| • | 005D: Workers' Compensation Discount |

| • | 006: Administrative Fee |

| • | 006D: Administrative Fee Special Discount |

| • | 006M: Adminstrative Fee Adjust to Min/Max |

All other codes are added to the end of the list at bill time, such as benefits and deductions.

Sales tax codes are formatted TAX{xx}, where xx is the two-character state code, for example, TAXOH for Ohio state tax.

TB{BenefitPlanID} is the first bill code checked during the termination of an employee's benefits. For example, a benefit plan MEDABC would look for the bill code TBMEDABC. If present, the system uses that, otherwise the system looks for a code TEBA (terminated employee benefit acceleration). This method gives the ability to create accounting detail where it is warranted while lumping smaller plans into one TEBA bucket.

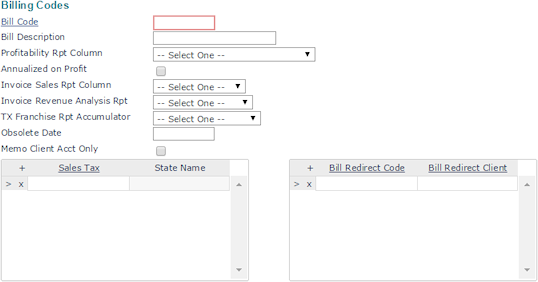

| 1. | Open the Billing Codes form and complete the following fields: |

| Field | Description | ||||||

|---|---|---|---|---|---|---|---|

| Bill Code |

Enter or select the Bill Code that describes a billing entry. If you select this field, a selector form displays where you can search for a specific bill code or its description or select a code from the list that displays. When this form opens, the bill code, description, and obsolete date display. To filter the search to display only Obsolete codes, select Yes in the Obsolete field (the default is No). (Note: Codes with an obsolete date earlier than the current date do not display in the selector form.) To refresh the list, select Reset Search and Filters. |

||||||

| Bill Description | Enter a Bill Description of this Bill Code. The description displays on invoices if the bill format does not normally include this bill code. It does not display on normal invoices if the billing code is included in the usual invoice format. | ||||||

| Profitability Rpt Column | Select the Profitability Rpt Column of the report in which to include this billing code. | ||||||

| Annualized on Profit | Select Annualized on Profit to annualize the bill code for the profitability report. | ||||||

|

Invoice Sales Rpt Column |

Select the Invoice Sales Rpt Column of the Invoice Sales report in which to include this billing code. |

||||||

|

Invoice Revenue Analysis Rpt |

Select the Invoice Revenue Analysis Rpt column of the Invoice Revenue Analysis report in which to include this billing code. |

||||||

|

TX Franchise Rpt Accumulator |

Select the TX Franchise Rpt Accumulator to print on the Texas Franchise Report. The system adds any amount billed to this code to that accumulator. |

||||||

|

Obsolete Date |

Enter the Obsolete Date when this billing code becomes obsolete, if ever. |

||||||

| Memo Client Acct Only |

Select Memo Client Acct Only if this bill code should not display in the actual invoice, but remain part of the client accounting system. Note: The Memo Client Acct Only field setting is only available for retirement 401(k) match reporting through PEO accounting. Selecting this option causes the client accounting record to be out of balance by the amount of the memo entries unless the client accounting records include a memo offset line. To do this, your organization must have a memo offset set up in PEO Client Accounting as an other bill code. The breakdown of these non-billed entries can be helpful on a retirement plan with a match that your organization does not collect. |

||||||

|

Sales Tax |

Enter each Sales Tax state code where taxes apply to this billing code. If this is a state-based sales tax billing code, do not enter any states in the table. |

||||||

|

Bill Redirect Code/Bill Redirect Clent |

To redirect billing:

|

| 2. | Click Save. |